Musings about technology, telecommunications, public policy, regulation, society, media, war, culture, politics, travel and the nature of things... "The ultimate test of a moral society is the kind of world that it leaves to its children" ...Dietrich Bonhoeffer

December 27, 2012

December 26, 2012

Singles Voters Make the Difference

"As a surging percentage of US voters, singles are a game changer. They see the world differently in terms of their own personal security and the future – or at least that is how they vote.

To get a sense of how powerful the marriage effect is, not just for women but for men, too, look at the exit polls by marital status. Among non-married voters – people who are single and have never married, are living with a partner, or are divorced – Obama beat Romney 62-35. Among married voters Romney won the vote handily, 56-42."

Thomas Sowell: Fiscal Cliff Notes (Part II) — Frontiers of Freedom

Thomas Sowell: Fiscal Cliff Notes (Part II) — Frontiers of Freedom: "The bottom line is that Barack Obama’s blaming increased budget deficits on the Bush tax cuts is demonstrably false. What caused the decreasing budget deficits after the Bush tax cuts to suddenly reverse and start increasing was the mortgage crisis. The deficit increased in 2008, followed by a huge increase in 2009.

So it is sheer hogwash that “tax cuts for the rich” caused the government to lose tax revenues. The government gained tax revenues, not lost them. Moreover, “the rich” paid a larger amount of taxes, and a larger share of all taxes, after the tax rates were cut.

That is because people change their economic behavior when tax rates are changed, contrary to what the Congressional Budget Office and others seem to assume, and this can stimulate the economy more than a government “stimulus” has done under either Bush or Obama."

http://townhall.com/columnists/thomassowell/2012/12/05/creators_oped

Washington Times, Thomas Sowell: Fiscal Cliff Notes (Part I), 12/4/12

Washington Times, Thomas Sowell: Fiscal Cliff Notes (Part I), 12/4/12“All the political angst and moral melodrama about getting ‘the rich’ to pay ‘their fair share’ is part of a big charade. This is not about economics, it is about politics. Taxing ‘the rich’ will produce a drop in the bucket when compared to the staggering and unprecedented deficits of the Obama administration.”"

'via Blog this'

December 23, 2012

Arthur Brooks: America's Dangerous Powerball Economy - WSJ.com

Arthur Brooks: America's Dangerous Powerball Economy - WSJ.com: "It is a simple fact that the United States is becoming an entitlement state. The problem with this is not just that it is bankrupting the country. It is that the entitlement state is impoverishing the lives of the growing millions dependent on unearned resources. The good news is that we have a golden opportunity to rein in entitlements, for the first time in many years.

But there is bad news, too. President Obama argues that the real problem is undertaxing the public, not overspending on entitlements. He is currently asking Congress for $1.3 trillion in tax increases over a decade but less than $1 trillion in spending cuts—largely deferred, meaning much of that may not even take place. A study by Ernst & Young shows that Mr. Obama's proposed tax hikes would force small businesses to eliminate about 710,000 jobs."

December 16, 2012

Welcome to Saudi Albany? - NYTimes.com

Some pretend that the producers should pay the full price of the fracking revolution Consumers always pay the cost of goods and services. That's the way it should be in our economy.

It's to everyone's benefit to keep these costs rational and consistent with environmental and health protection but not bloated by unnecessary constraints and huge new government bureaucracies.

December 12, 2012

The 2,000-Year-Old Wonder Drug - NYTimes.com

While I endorse the use of a daily aspirin dose and take one myself, I don't endorse the underlying ideology this author suggests early in the piece that certain substances be banned by political fiat as Bloomberg is doing in New York.

For sure, I agree that people should be encouraged to participate in a healthy lifestyle and educated about the negative consequences of certain foods and substances, but banning these for all people is an abridgment of freedom and liberty. This is a very difficult area, I know, particularly for those substances that are not highly addictive or gateways to addictive substances that are damaging to health and society, e.g., hard drugs and the crime that follows their use.

I agree with the author that society should not have to bear the consequences of stupid or self-damaging behaviors by individuals who abuse their freedom and avoid responsibility and accountability. A reasonable way to accomplish that is by society and government condemning such behavior and making it very expensive monetarily for people to participate in it. The high taxes on tobacco products is a case in point. Another way is for insurance costs for people who abuse themselves with dangerous substances or behavior to be higher. Fairness and reasonableness demand there be a price paid by individuals for their risky behavior.

This is not meant to be mean or unforgiving of people who cannot control their lives, but those who can and won't should not be able to ride free on society's largess.

November 20, 2012

Facts and Bias in a Social Media News World

Spin vs. facts in a Twitter and Facebook era. Yes, electronic media complicates the traditional journalist's, editor's and government roles, but governments have always spun the facts into propaganda when they thought they could and the news media have always held biases. I believe a very important bias is what is chosen NOT to be reported by traditional media, either through deliberate choice or lack of resources. Social media, though often tough to fact-check, allow little to go unreported.

The burden is on us, the consumers of news, often ill-equipped to sort and sift often clouded by our own biases.

October 30, 2012

The Unemployment Rate is Not the Best Measure of the Economy or a President

"To: anyone who will listen.....Accompanied by this chart :

Since I've been trying to pay attention to the spin by both sides as we approach Nov. 6, (I've already voted, btw---for Obama), I went to the website of the Bureau of Labor Statistics, and found the following eye-opening chart. It clearly shows the decline in the unemployment rate during the Bush years, then the precipitous climb (a loss of 2.5 million jobs) during his last year in office. The trend continued when Obama took over the mess, and, since '09, a steady, gradual decline in UNEMPLOYMENT.

What I'd like to know is why this clear picture isn't being plastered ALL OVER for everyone to see......let's get going!!!!!"

My response to her (Using BLS data):

The reality is that in August 2012, we had about the same non-farm payroll (133,244,000) as we did in January of 2005 (132,453,000). In Jan 2008 it was 138,023,000. In January 2009 it was 133,561,000. Meanwhile, the population has grown from 295,753,000 to 314,159,000 or 18,406,000 since January 2005. So, Obama spin claims to have created 5 million jobs, yet the number of people working has not increased since he took office.

This also means that the number of working Americans is essentially the same as it was 7 years ago while the population has increased by 6.2%.

Meanwhile the median household income (inflation adjusted) looks like this:

2005 $53,371

2008 $52,546

2011 $50,054

Change = -6.2%

So, looking at the economy from the data about workers and population and household income, shows a very weak economic recovery, one that does not provide sufficient good paying jobs for our people, many of whom have dropped out of the workforce and/or stopped looking for work These people are not included in the unemployment rate determination. Some estimate the true unemployment rate to be closer to 11-12%.

I’d love to talk more about this with you, but Obama’s positive contribution to the economic ‘recovery,’ such as it is, is de minimus, despite he and the Congress increasing the debt by ~ 6 $Trillion to stimulate it.

All spin aside, the media and we give far too much credence to the power of a President over the economy. Congress is the real player, albeit heavily influenced by the President, when it comes to fiscal and economic policy and their record is dismal. For example, the Senate has not passed a budget in more than three years.

Romney’s approach makes more sense to me than another 4 years of Obama.

October 27, 2012

New York faces most intense storm in history - Outside the Box - MarketWatch

A nasty confluence of forces seem to be converging on the NY-NJ area. This is a Friday, 10/26/12 forecast so a lot can happen before the storm hits in a few days.

"...For those south of the center, the storm’s circulation will actually be pushing flooding seas away from shore, lessening potential impacts.'via Blog this'

Right now, the most reliable model tracks have clustered in a relatively tight range from Delaware to New York City. Counter-intuitively should the center of the storm make a direct strike on New York City, the city may actually be spared some of the more serious coastal impacts from the storm.

Should the storm continue on its current path (the National Hurricane Center’s most likely landfall is now in southern New Jersey), all bets are off for the five boroughs.

The latter scenario — the one that now appears most likely — would have many feet of ocean water funneled into New York Harbor over a period of up to 36 hours. Unlike Irene, which quickly transited New York City last year as a weakening tropical storm, Sandy may actually be in the process of strengthening when it makes landfall.

The result could prove incredibly damaging for coastal residents and critical infrastructure. Keep in mind that Irene was only inches away from flooding subway tunnels in Lower Manhattan. Storm-surge forecasts for this scenario haven’t been officially released yet, but six to 10 feet in the city is not out of the question in a worst-case scenario.

That result would put about 700,000 people’s homes underwater, according to a Climate Central interactive analysis. Add to that waves of 10 to 20 feet on ocean-facing shores, and an additional foot or so of tidal influence from the full moon, and we could be dealing with quite a mess on our hands.

With National Geographic reporting that sea level rise is already accelerating at three to four times the global rate in the Northeast due to climate change, impacts are expected to be worse than if the same exact storm would have hit several years ago.

Should Sandy veer further north of its current track and make landfall right over the city, storm surge could be dramatically lessened, though the city could receive about double the amount of rainfall — up to a foot or more.

For these reasons, if I were a resident of New York right now, I’d be rooting for a direct hit. If given a choice, I’d take 12 inches of rain over six feet of coastal flooding any day.

October 24, 2012

Ain't It the Truth!

Journalism and the truth: More complicated than it has ever been — Tech News and Analysis - http://gigaom.com/2012/10/23/journalism-and-the-truth-more-complicated-than-it-has-ever-been/?utm_medium=referral&utm_source=pulsenews

Race for President Leaves Income Slump in Shadows - NYTimes.com

Race for President Leaves Income Slump in Shadows - NYTimes.com: "Many of the bedrock assumptions of American culture — about work, progress, fairness and optimism — are being shaken as successive generations worry about the prospect of declining living standards. No question, perhaps, is more central to the country’s global standing than whether the economy will perform better on that score in the future than it has in the recent past."

Some well-reasoned analysis in this piece, most of which I agree with. In the 'silly season' before elections politicians often deal with 'froth' in their campaigns because the underlying forces driving our fiscal mess and poor performing economy cannot be dealt with in a sound bite or 30 second ad.

The fundamental issue in the Presidential campaign is whether the government is the best solver of our economic and fiscal problems of whether the role of the private sector can best do it. I favor the private sector and I think more and more voters are coming around to that viewpoint because they see the trillion dollar deficits of TeamObama have produced poor results and unsustainable debt but little economic improvement.

Missing from the story is the corrosive effect of entitlements on America's fiscal health. Entitlements persuade people who have them not to lose them and to vote accordingly. (Entitlements do little to grow the economy except provide a source of consumer spending.) Politicians know this and too many pander to the recipients for their votes.

The fundamental problems in our economy have no quick fix, yet that's what too many voters unrealistically expect and that politicians over-promise with their 'make sure...' rhetoric.

The only way to improve incomes is to grow the pie (the economy) not redistribute it. Even if all the income of the super-rich was confiscated and applied to the deficits it would be a drop in the bucket.

It boils down to this: Which Presidential candidate and Congresspersons do voters trust to best set a course to solve the problems we face. Romney's proposals ring truer than Obama's.

'via Blog this'

October 16, 2012

The German Woes of Big Wind

http://www.businessinsider.com/germanys-wind-power-chaos-2012-9

Written by a Brit, this story suggests that Germany's rapid investment in Big Wind and solar is causing costly technical problems in managing the grid for stable, reliable operation. They have also decided to shut down their nukes which exacerbates the grid reliability problem.

September 29, 2012

Empathy in Plolitics

Many Democrats seek to entitle those with less, some of which, but not all, clearly need help. They also use the tool of class warfare to emotionally tie those who are receiving 'entitlements (a nasty loaded word) to them as the party who 'cares.' Most Republicans do not lack empathy, but reject the bureaucratic government model to which many citizens have transferred much of their empathy and personal responsibility and which grows unsustainably larger and deeper in debt providing ever more 'benefits' (another loaded word).

Societies have always had the super-rich (in relative terms) and they almost always have been demonized by those with much less. What's missing in the present economic malaise is enough productive work ( jobs) for willing people to support themselves, not a lack of empathy for the truly needy.

The debate is over the policies that will best provide the opportunity to earn a decent living in a society undergoing technological upheaval, not which political party is more empathetic.

September 12, 2012

Obama Cannot be Trusted in Foreign Policy

WSJ NEWS ALERT: U.S. Ambassador to Libya Is Killed in Attack on Consulate - dusher@gmail.com - Gmail

News Alert from The Wall Street Journal

"Libyan officials said the U.S. ambassador, J. Christopher Stevens, and three other Americans have been killed in an attack on the U.S. consulate in Benghazi, the Associated Press reported.

Demonstrators on Tuesday attacked the consulate and breached the walls of the U.S. Embassy in Cairo, amid angry protests over a film by a U.S. producer that mocks and insults the Prophet Muhammad."

Breaking News AlertThe New York TimesWednesday, September 12, 2012 -- 7:24 AM EDT-----

U.S. Ambassador to Libya Is Reported Killed by Protesters in Benghazi

The Libyan government said Wednesday that United States ambassador Christopher Stevens was killed along with three of his staff in an attack on the consulate in Benghazi Tuesday night in the first death of an American envoy abroad in more than two decades.

The U.S. State Department declined to confirm or deny the reports and said the previous night that only a single unnamed embassy employee had been killed. But if confirmed, the killing, during at attack by an armed mob angry over a short American-made video mocking Islam’s founding prophet, threatens to upset Washington’s relations with the new Libyan government that took over after the ouster of Col. Muammar el-Qaddafi and sour American public opinion about the prospects of the democratic opening of the Arab spring.

Mr. Stevens, a veteran of U.S. diplomatic missions in Libya, served in Benghazi during the uprising against Colonel Qaddafi, and he was widely admired by the Libyan rebels for his support of their struggle to overthrow Colonel Qaddafi.

So much for the Arab Spring widely hailed as a positive development when it first started. Deposing dictators is a good thing. Islamic mobs that we have seen in Libya and Egypt in the last day or two threaten the rule of law and basic security that democratic experiments must have in order to succeed.

What will be the American response?

'via Blog this'

August 29, 2012

Vermont is #1. Not Desirable

http://www.forbes.com/2009/03/30/highest-state-taxes-lifestyle-real-estate-state-taxes.html

Vermont is the state with the highest taxes. But we already knew that. We have many apologists for this situation but the responsibility rests solely on the the liberal government establishment and those who elect them.

August 11, 2012

The November Election is A Clear Choice of Worldviews

News Alertfrom The Wall Street Journal

Mitt Romney picked Rep. Paul Ryan as his running mate, a decision that could spark enthusiasm for the Republican ticket among conservatives and all but ensures the election will turn to deep philosophical divisions between the two parties over spending, taxes and entitlements.

In Mr. Ryan, 42 years old, the Romney campaign gets a conservative who has spent recent years at the center of national debates about the size and scope of the federal government. With his proposals to revamp entitlement programs for future retirees and the poor, he has become a hero to conservatives and a target for liberals.

The pick was officially announced on Mr. Romney’s phone app just after 7 a.m. Mr. Romney plans to hold an event at 9 a.m. on the USS Wisconsin, which carries the name of Rep. Ryan's home state.SB1000087239639044340400457758

http://online.wsj.com/article/

2112521141598.html?mod=

August 5, 2012

SwiftKey tests

Just downloaded SwiftKey and am testing it on my new nexus 7. Need to get a lot more words typed to truly evaluate how well it performs. It seems snappy and accurate so far. I must remember to watch the word selection bar rather than the content window. The theme choices are cool And the space insertion feature is very helpful because I constantly forget to insert spaces. :-). It even has smiley face insertion options.

So far it looks like a time saver!

August 3, 2012

Job Growth in Private Sector

WSJ reports that July's job growth was in the private sector. That's good news. Government should continue to shrink even faster for a healthier economic rebound.

"The Labor Department Friday said private companies accounted for all of the growth in July payrolls, adding 172,000 jobs during the month. Governments, meanwhile, shed 9,000 positions. The federal work force shrank by 2,000."

July 30, 2012

Works and Days » California: The Road Warrior Is Here

Works and Days » California: The Road Warrior Is Here: "Sometimes, and in some places, in California I think we have nearly descended into Miller’s dark vision — especially the juxtaposition of occasional high technology with premodern notions of law and security. The state deficit is at $16 billion. Stockton went bankrupt; Fresno is rumored to be next. Unemployment stays over 10% and in the Central Valley is more like 15%. Seven out of the last eleven new Californians went on Medicaid, which is about broke. A third of the nation’s welfare recipients are in California. In many areas, 40% of Central Valley high school students do not graduate — and do not work, if the latest crisis in finding $10 an hour agricultural workers is any indication. And so on."

July 11, 2012

SS United States May be Partially Restored

It was a fast crossing with brief stops in Southampton and Le Havre. We encountered one storm during dinner which tossed people, chairs and dishware to the deck.

A few years ago we were in Philadelphia I noticed the ship in the harbor and wondered what would become of her. Glad to see that she may have a better future than the scrap yard.

June 22, 2012

The Renewal of Civic Capitalism - NPQ – Nonprofit Quarterly - Promoting an active and engaged democracy.

"Civic capitalism is all about a robust business community, an engaged citizenry and a government that actively promotes your ability to provide a check on large institutions, from banks to corporations, and on government itself. It is about ensuring that democratic values endure, even as politicians and movements come and go. It is about rooting out corruption and insisting on honesty, opportunity, and full information, not just because it is the right thing to do, but because markets and civil society cannot function otherwise. Civic capitalism takes the long view, and teaches us that the government has a role in minimizing risks to the system—financial and otherwise—because that civil society is the base from which entrepreneurs and firms operate."

'via Blog this'

June 15, 2012

Where Paul Krugman, Keynes are vulnerable - Howard Gold's No-Nonsense Investing - MarketWatch

I believe America's unemployment is structural for a number of reasons, not the least of which is the impact of technology.

Growing the economy is complicated by the structural changes and dislocations from accelerating technological change which are ‘eating’ traditional jobs, jobs that previously required humans, previously low-skill, low-priced humans. What’s happening now is that even higher skills are being replaced by technological efficiencies.

Already in many industries and occupations, we have seen that digital and robotic technologies have permanently displaced jobs and skills. With investments in these technologies companies can increase economic output without the corresponding labor component that was both expected and experienced experienced by workers in the past as America exited economic doldrums. The upshot is that many jobs simply will not return and the doldrums are more or less permanent.

As only one example among many, think about the implications in the not too distant future of cars and trucks that drive themselves more adroitly and safely than people can. Google and several other companies are developing such vehicles and as states allow them to to be registered and operated, we can expect more jobs to disappear.

The high skills required to service this new economy are in short supply because the education system lags behind the pace of technological change. Meanwhile, our self gratifying culture works against people desiring to be equipped to work hard to succeed. The ‘entitlement mentality’ pervades far too many lives. We see it in the growing expectations of a government that cannot afford these demands in an economy that is predicted to grow at half its historic rate into the future.

"But what if the problem isn’t only a dearth of demand? Krugman is adamant that current U.S. unemployment is not structural — i.e., that it has deeper causes such as a mismatch of skills between workers and the available jobs.

“…Structural unemployment is a fake problem, which mainly serves as an excuse for not pursuing real solutions,” he wrote. “…All the facts suggest that high unemployment in America is the result of inadequate demand — full stop.”

Actually, economists are divided on this issue — studies by the Chicago and San Francisco Fed support Krugman, while a recent International Monetary Fund paper pegged the structural contribution to long-term U.S. unemployment at 40%. That’s two million people, hardly trivial."'via Blog this'

June 1, 2012

A Look at Chrome OS Future

http://m.zdnet.com/blog/google/5-reasons-everyone-will-be-using-chrome-os-in-3-years/3649?pg=2

This ZDNET writer believes the Chrome OS will win a big chunk of market share. The battle is on between Google, MS and Apple. A key to winning will be the enterprise.

May 17, 2012

Verizon to kill unlimited data plans for existing subscribers | Mobile - CNET News

"Verizon issued this statement on Thursday morning (5/17/12):

As we have stated publicly, Verizon Wireless has been re-evaluating its data pricing structure for some time. Customers have told us that they want to share data, similar to how they share minutes today. We are working on plans to provide customers with that option later this year.

We will share specific details of the plans and any related policy changes well in advance of their introduction, so customers will have time to evaluate their choices and make the best decisions for their wireless service. It is our goal and commitment to continue to provide customers with the same high value service they have come to expect from Verizon Wireless."

May 13, 2012

World Debt and GDP - Unsustainable

May 10, 2012

Facebook's IPO - What to do?

From The Economist: "Investors who buy shares in the IPO will also have to accept that Mr Zuckerberg will continue to control more than 50% of the voting rights. “One person owning so much of a potential blue-chip company is more or less unheard of,” says Debarshi Nandy, a professor at Brandeis International Business School. Other tech firms, such as Google, have flourished under the tight control of small groups of founders, and Mr Zuckerberg shows every sign of maturing into an exceptional technology leader. But if something were to go badly wrong at Facebook in future, its shareholders will be able to do little more than give him a big thumbs down."

Vt homeowners work to help Lake Champlain - WCAX.COM Local Vermont News, Weather and Sports-

Our neighbor, Craig, and LCI folks discussing the of control stormwater runoff to keep pollutants out of the lake. Also includes a quick shot of our house.

May 7, 2012

Many Competing Paths on the Road to a Phone Wallet - NYTimes.com

Android in advanced smartphones such as Samsung's Galaxy Nexus line support NFC (Near Field Communications), now it seems merchant terminals will be NFC capable in the next 5 years according to this NY times story. This method of payment makes a lot of sense rather than carrying a bunch of plastic in your wallet.

The interim competition will be from Square and PayPal who furnish their own smartphone card reader devices free to individuals and small businesses. I use Square infrequently for business and non-profit use. I find it easy, and convenient.

"Merchants are facing heavy pressure to upgrade their payment terminals to accept smart cards. Over the last several months, Visa, Discover and MasterCard have said that merchants that cannot accept these cards will be liable for any losses owing to fraud.

“Everybody is going to be upgrading,” said Jennifer Miles, an executive vice president at VeriFone, which provides payment terminals to most merchants in the United States.

While updating the terminals for smart cards, VeriFone also plans to upgrade for smartphone wallets, providing the capability for near-field communication, the technology used by the Google and Isis wallets, the two biggest smartphone wallet projects."

May 6, 2012

April 2012 Employment Information - Grim News

Jobs, the fodder for much political rhetoric in this campaign season, are not growing and we have little evidence of a sustained economic recovery. Too many people are not in the labor force.

I believe that we are a long way from creating enough good paying jobs with a supply of people qualified to take them. Capital investments in technology will continue to substitute for labor for the foreseeable future, IMHO.

"* The longer-term picture of labor force withdrawal is kind of shocking. Total household employment is down by 4.4 million since the Great Recession began in December 2007, and the number of unemployed is up by 4.9 million. The civilian population is up 9.6 million – but the labor force is up just 447,000. The number classed as not in the labor force is up by 9.2 million – and those not in the labor force and wanting a job is up 1.7 million. In other words, just 5% of the increase in the adult population over the last 4 1/3 years has found its way into employment; the other 95% are not in the labor force.

* The unemployment rate fell by 0.1 point to 8.1%, its lowest level in more than three years. The number of unemployed fell by 173,000 – but the labor force shrank by almost the same amount, 169,000.

Without the labor force shrinkage, the unemployment rate probably would have been unchanged. Within the unemployed, the number of job losers fell – but so did the number of re-entrants and voluntary leavers, suggesting that the increased confidence we saw through those indicators in recent months may be dissipating. With the quit rate down, and the long-term unemployed dropping out of the labor force, the mid-ranges of unemployment duration (from 5-26 weeks) saw an increase, as the extreme short- and long-term durations fell."

April 30, 2012

Barnes & Noble, Microsoft ink $300M deal on e-reading | Microsoft - CNET News

The next shoe to drop may well be some advanced hardware from Google via its recent purchase of Motorola. I presume that Microsoft has acquired or is obtaining the licensing it needs for video form Hollwood.

With these four titans rumbling in the digital forest, the battle will be huge and all the competition will be good for consumers. The days of dead-tree books are inevitably winding down

"The companies announced today that Microsoft has invested $300 million into a new Barnes & Noble subsidiary, known as Newco until the company can come up with a name. The $300 million investment will give Microsoft a 17.6 percent equity stake in the firm. Barnes and Noble, which assumed a $1.7 billion valuation on the subsidiary, will retain 82.4 percent ownership."

April 26, 2012

Will the Trend Continue?

April 25, 2012

Carol's latest Wooliedale

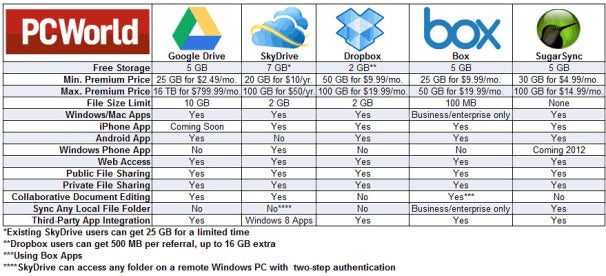

Google's Gdrive Cloud Storage is Here

April 22, 2012

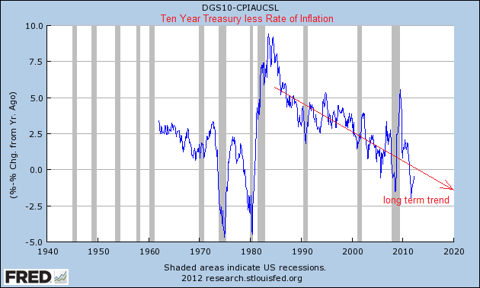

The FED has Few Tools to Fight Inflation or Stimulate the Economy

"...Reading between the lines - the Fed is not seeing economic traction anytime soon. Consider that USA monetary policy is based on gold standard conventions which becomes less and less effective as government debt grows. Further modern day monetary policy for a major currency is effected[sic] by leakage and actions by other currencies.

The Fed cannot allow interest rates to raise when:

- the servicing costs of government debt would strangle the economy; or,

- if the government goes on an austerity program, which will contract the economy, and loose monetary policy must prevail to try to mitigate a shrinking economy; or,

In short, the USA is between a rock and a hard place - as it is almost certain that rising interest rates would apply abnormally large brakes on the economy. Realistically, there is little difference between 0% and 0.5%, so politically based monetary policy movements are possible.

- the stalemate in Washington is not allowing long term solutions as the debt continues to grow. Under this circumstance, the Fed must accommodate the lack of leadership for fiscal policy.

Yet, there are too many parallels with Japan (mainly debt plus demographics) to believe the USA can escape economic doldrums without a major shift to a less of a gold standard approach to monetary policy.

In the meantime, unless you are in the 1% - prepare for a less affluent future. In the olden days (pre-New Normal), your plan for retirement was based on less risky bonds for income and cashing out the old hacienda so that one could make lifestyle decisions. For those already retired, and the boomers - time to look for Plan B as shown on the below chart which shows real return on 10 year treasuries."

(click to enlarge)

April 21, 2012

America's Crisis of Character - WSJ.com

When political and other 'leaders' pander to voting blocs rather than set high standards of behavior and character, we have the evidence that america is losing the high ground.

"People in politics talk about the right track/wrong track numbers as an indicator of public mood. This week Gallup had a poll showing only 24% of Americans feel we're on the right track as a nation. That's a historic low. Political professionals tend, understandably, to think it's all about the economy—unemployment, foreclosures, we're going in the wrong direction. I've long thought that public dissatisfaction is about more than the economy, that it's also about our culture, or rather the flat, brute, highly sexualized thing we call our culture..."

April 16, 2012

April 13, 2012

Microsoft Inks Its Biggest Cloud Deal Yet: 7.5M Students And Teachers In India | TechCrunch

The cloud reigns!

"Microsoft has announced that it has signed its largest-ever cloud services deal, an agreement with the All India Council for Technical Education to deploy Microsoft’s Live@edu service to some 10,000 technical colleges in the country, covering 7.5 million users."

"To give an idea of the relative size of the AICTE deal compared to others Microsoft has signed, one of its more recent deals was with the Kentucky Department of Education covering 700,000 users. In all, there are around 22 million people using Microsoft’s Live@edu service, meaning that this newest deal in India represents about one-third of all of Microsoft’s cloud/education business."

April 12, 2012

Caine's Arcade

Enjoy a bit of childhood happiness!

A 9 year old boy - who built an elaborate cardboard arcade inside his dad's used auto part store - is about to have the best day of his life.

Help Caine's Scholarship Fund:

http://cainesarcade.com

Caine's Arcade Online:

http://facebook.com/cainesarcade

http://twitter.com/cainesarcade

Credits:

Directed by Nirvan

http://twitter.com/nirvan

Gas Glut Rejiggers Industry - WSJ.com

Even here in Vermont where our natural gas comes form Canada via Vermont Gas, Tom Evslin and partners have created a new company to take advantage of these low prices. NG Advantage hopes to compress the gas at a central location and truck it to large fuel users in northern NH, VT and NY not reached by pipelines at a price lower than their present fuel.

April 8, 2012

True North Reports — Vermont's Cloud Tax Controversy

Rob Roper, in an interview with Mike Wasser, [a state tax attorney with State Tax Services, LLC, and who served in the Vermont Tax department at the time the legislation in question regarding the cloud tax was implemented] provides an excellent overview of the issue that flared up in Vermont recently.

I think the issue should be addressed head on by the Legislature. The technical bulletin issued by the Vermont Tax Department in 2010 should be rescinded. and no further back taxes should be levied. Any already paid should be refunded.

The issue is enormously important because so much functionality will be living in the cloud that jurisdictional issues become very complex. The whole issue should be given serious thought about whether a tax should be levied and who should be responsible for collecting it.

"...I want to clarify that when this bulletin first came out, I don’t believe it was done with any malicious intent by the tax department. It’s a complicated issue as we’ve discussed… and they just got it wrong…. It’s really in how you address a mistake like that that makes a difference. What concerns me is in larger part, to my knowledge, nobody that’s looking at how to resolve this issue has even bothered to consult the former tax commissioners who actually administered this policy. Why aren’t they asking commissioner Pelham and commissioner Westman what the department’s official policy was on cloud services?...”"

April 6, 2012

Obama v. SCOTUS - The Washington Post

“I’m confident that the Supreme Court will not take what would be an unprecedented, extraordinary step of overturning a law that was passed by a strong majority of a democratically elected Congress.”"Such an absurd statement from POTUS. He's allegedly a Constitutional scholar? The healthcare act was passed on a Sunday in Congress with only a few votes in the House favoring it. No Republicans voted for it.

April 4, 2012

Obama Predicts Health Law Will Survive Supreme Court Case - WSJ.com

"President Barack Obama predicted Monday that the Supreme Court would uphold his signature health-care law and said that overturning it would be a prime example of judicial overreach.

President Obama said at a Rose Garden press conference he is "confident" the Supreme Court will uphold his health-care reform law. (Photo: AP)

It was a rare instance of a president laying out his own arguments about a Supreme Court case before the justices are set to reach their decision.

In his first public comments about the case since the justices took it up last week, Mr. Obama appeared to be framing the political argument he would make should he have to face voters this fall after a loss at the high court..."

April 3, 2012

The VPR Table: The VPR Table: Church of the North Woods

April 1, 2012

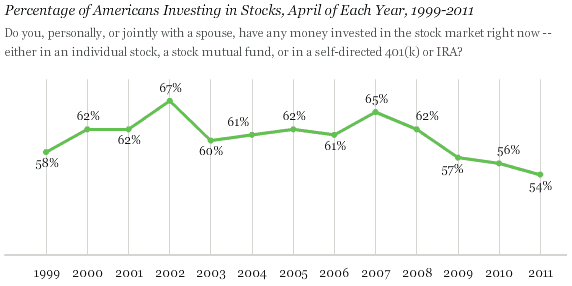

11% Fewer Americans in the Stock Market Since 2007

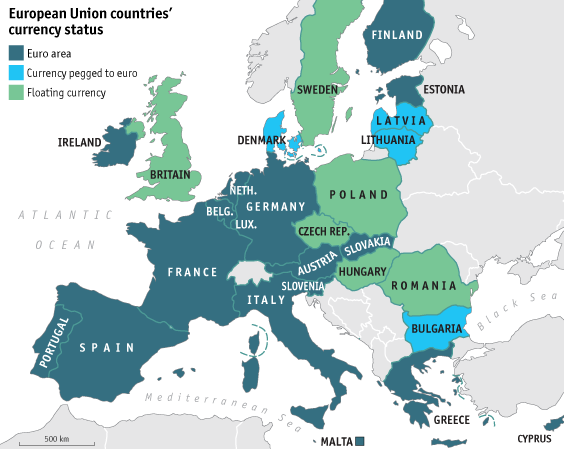

Spain Now at the Top of the European Crisis Heap

Back from ParisDavid Kotok

We are back from Paris. The head is filled with new info. For the publicly available portion of the conference, see the GIC website, www.interdependence.org. The remaining comments will be my personal “takeaways” from both public and private conversations. By Chatham House Rule and Jackson Hole Rule, these words are attributable only to me. All errors are mine.

1. In my view, the situation in Portugal is unraveling. This may be the second shoe to drop in the European sovereign debt saga. Now that Greece has paved the way, the speed of unwind with Portugal may be much faster. I do not believe the markets are prepared for that. Runs are affecting Portuguese banks. Euro deposits are shifting to other, safer countries and the banks that are in those countries. Germany (German banks) is the largest recipient. Remember, deposits in European banks are guaranteed by the national central banks and the national governments, not the ECB. There is no FDIC to insure deposits in the Eurozone.

2. The issue is that Greece was supposed to be “ring-fenced.” Notice how European leaders have stopped using that word. Their new word is firewall. If a second country (Portugal) restructures, the sovereign debt issues become systemic rather than idiosyncratic. That becomes the second game-changer. Systemic risk needs big firewalls. We learned that the hard way with Lehman and AIG, which were systemic, vs. Countrywide and Bear Stearns, which were “ring-fenced” – or thought to be ring-fenced at the time.

3. A game-changer was the use (not threat) of the collective action clause by Greece. CAC altered the positions of the private sector. It rewrote a contract after the fact. That is why Portugal’s credit spreads are wide: the private-sector holders of Portuguese debt know that a CAC can be used on them, too. The same is true for all European sovereign debt. A re-pricing of this CAC risk is underway.

4. Private holders of Greek debt had several years to get out before the eventual failure. Those that did not get out were crushed in the settlement. Greece is now a ward of governmental and global institutions like the ECB, IMF, and others. It is unlikely to have market access for years. This is another game-changer. In the old crisis days, the strategy was to regain market access quickly and restore private-sector involvement. In the new Eurozone-CAC crisis days, the concept is to crush the private-sector holders, and that means no market access for a long time. Instead, we will have ongoing and increasing sunk costs by governmental institutions. Caveat: government does not know how to cut losses and run. Government only knows how to run up small losses until they are huge. Witness Fannie Mae in the US. Witness the sequence that allowed Greece to fester for years. Government does not know how to take the “first loss,” which is usually the smallest lost. Government does know how to run up moral hazard.

5. The term moral hazard means the action is done today and the price is determined later, after the chickens come home to roost and crap all over the coop. That is the nature of government everywhere. By the time the chickens return, the political leaders have changed. Those who took the moral hazard risk are gone. Those who inherited their mess are blamed during the cleanup. That is where we are today in Europe. Hence, the political risk is rising daily. Elections could change these governments, and the new governments may repudiate the actions of the old ones. We expect more strikes and unrest. That is how elections can be influenced.

6. European debt-crisis issues are lessons for the US. They belong in the political debate. Both political parties are responsible for our growing debt issues. Bush ran up huge deficits. Obama continued them. Each party blames the other. Neither takes on the responsibility of their actions. We shall see how this evolves between now and November.

I am more pessimistic about peripheral Europe than I have been. All that my co-author Vincenzo Sciarretta and I wrote in our book several years ago is now being reversed by policies. In the beginning, the Eurozone benefited immensely from economic integration and interest-rate convergence. Now it faces disintegration and divergence. Reverse the chapters in the book and play the film backwards.

Can Europe find a stabilizing level and resume growth? Time will tell. Meanwhile, political leaders and central bankers are going to be tested again.

This ain’t over. Yogi is correct.

March 29, 2012

TINPOTI!

I never had expectations of any privacy. Hackers are too clever and corporations mine data to foster marketing and advertising. This has been going on since 'Al Gore invented the internet' and it was commercialized in the 90's.

The pace is picking up as technology improves dramatically and nearly everyone uses the 'net.

Think about the enormous power of the NSA software that can collect, manage, filter and comb through all the data and find actionable nuggets in the counter-terrorism effort. Think, also, how effective (so far)this massive effort has been in preventing a second 9/11 in the U.S.

How much privacy are we willing to trade for security? The answer doesn't matter much because, well...TINPOTI!

March 28, 2012

U.S. Outgunned in Hacker War - WSJ.com

"Shawn Henry, who is preparing to leave the FBI after more than two decades with the bureau, said in an interview that the current public and private approach to fending off hackers is "unsustainable.'' Computer criminals are simply too talented and defensive measures too weak to stop them, he said."'Open Source' and 'Secure Networks' in the same sentence seems, well, oxymoronish! Brilliant hackers seem always one step ahead of the white hats. My view has been that some white hats are also grey/black hats on their own time.