Thanks to Steven Hansen at Seeking Alpha for this straightforward analysis of The Fed's policy and what seems a long future of near-zero interest rates. Disturbingly, the FED has few tools in the kit to control inflation or stimulate growth.

Meanwhile, Congress dithers as their unsustainable spending binge creates huge deficits and debt that will bury the country. What a sad commentary on our government and society. We need to turn this around, not for the benefit of the "1%," but for the future of the Republic.

A vote for Obama and his policies in November is a vote against the country's prosperous future and a general reduction in our standard of living.

"...Reading between the lines - the Fed is not seeing economic traction anytime soon. Consider that USA monetary policy is based on gold standard conventions which becomes less and less effective as government debt grows. Further modern day monetary policy for a major currency is effected[sic] by leakage and actions by other currencies.

The Fed cannot allow interest rates to raise when:

- the servicing costs of government debt would strangle the economy; or,

- if the government goes on an austerity program, which will contract the economy, and loose monetary policy must prevail to try to mitigate a shrinking economy; or,

In short, the USA is between a rock and a hard place - as it is almost certain that rising interest rates would apply abnormally large brakes on the economy. Realistically, there is little difference between 0% and 0.5%, so politically based monetary policy movements are possible.

- the stalemate in Washington is not allowing long term solutions as the debt continues to grow. Under this circumstance, the Fed must accommodate the lack of leadership for fiscal policy.

Yet, there are too many parallels with Japan (mainly debt plus demographics) to believe the USA can escape economic doldrums without a major shift to a less of a gold standard approach to monetary policy.

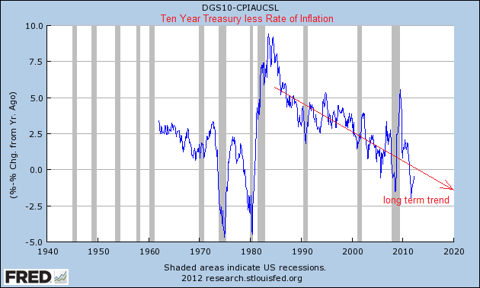

In the meantime, unless you are in the 1% - prepare for a less affluent future. In the olden days (pre-New Normal), your plan for retirement was based on less risky bonds for income and cashing out the old hacienda so that one could make lifestyle decisions. For those already retired, and the boomers - time to look for Plan B as shown on the below chart which shows real return on 10 year treasuries."

(click to enlarge)

No comments:

Post a Comment